Value Added Tax Implementation in Middle East Markets

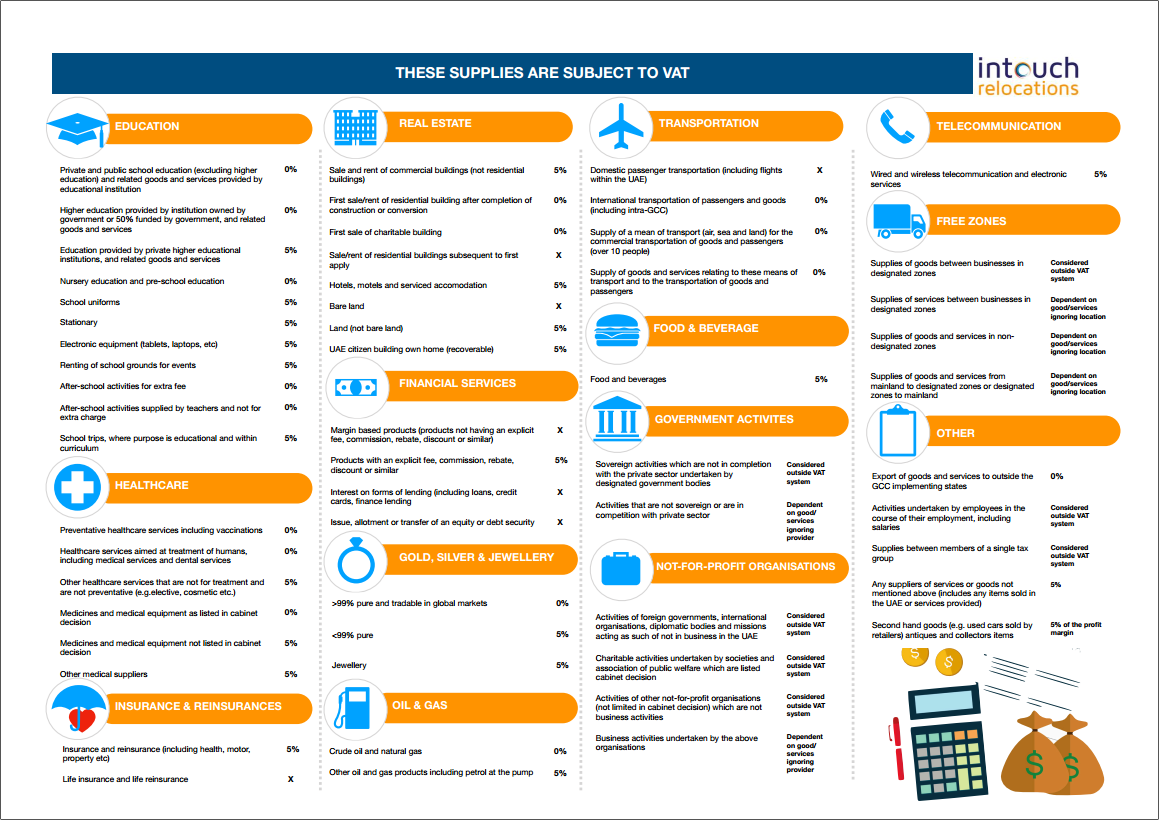

As of January 1st, 2018, Value Added Tax (VAT), at the rate of 5%, was introduced in the United Arab Emirates and Saudi Arabia. VAT is now applicable to most products and services, with an average resident now paying VAT almost everything, from food items and utilities, to shopping and consultancy services. This guide explains which products and services have an added 5% VAT, which have 0% VAT and which are exempted.

VAT and in fact any form of Tax, is new to the countries in question, therefore there may be some lack of clarity regarding certain areas of its implementation, where further clarification is required from the government. As we get more familiar with the new VAT requirements in the next few months, we expect to have a clearer picture on these individual items within the stated categories.

VAT in South Africa Increases

In another of our key markets, South Africa, VAT will increase from 14% to 15% from 1 April 2018.

In other related news, there will be a threefold Increase in Electricity from Monday 15th January. Consumers will have to bear a threefold increase in electricity tariff with the implementation of Value Added Tax (VAT) and a revised bill calculation system. Saudi Electricity Co. (SEC) will apply 5% VAT on electricity bills, connection and service charges.

The Electricity and Cogeneration Regulatory Authority (ECRA) has also revised its decades-old bill calculation system ECRA has removed the consumption slab calculation system. The new system will calculate up to 6000 kWh in the single slab. Residential electricity consumption of 1-6000 kWh per month will cost 18 halalas kWh. But consumption above 6000 kWh per month will cost 30 halalas kWh.

With the increase in electricity tariff, a consumer currently paying SR200 per month for modest power consumption for three air conditioning units, a few fluorescent tubes, iron, television, washing machine, game console and a refrigerator will now have to pay SR600 per month.